上课信息

上课时间:

上课地点:

| 报名时间 | 至 |

|---|---|

| 培训时间 | |

| 培训地点 | |

| 培训费用 | 650 |

| 授课安排 |

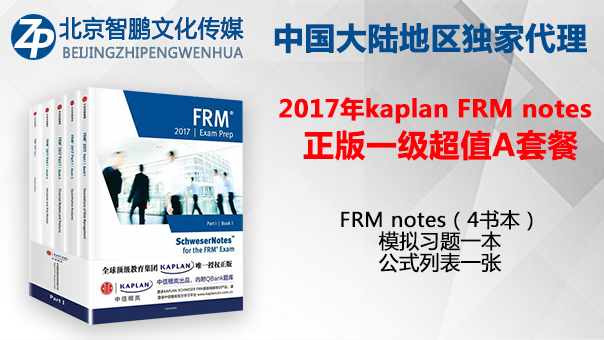

FRM一级A套餐内容介绍

套餐内容包含:

FRM 考试教材notes(BOOK1-book4) 4本书纸质+(模拟题书)1本纸质+(彩色三折页公式表) 1张纸质

售价:650元

下面是4本书和习题集目录:

FRM PART I BooK 1: (第一本目录)

FOUNDATIONS OF RISKMANAGEMENT

WELCOME TO THE 2017 SCHWESERNOTES V

READING ASSIGNMENTS AND LEARNING OBJECTIVES vIII

FOUNDATIONS OF RISK MANAGEMENT

1:Risk Management:A Helicopter View 1

2:Corporate Risk Management:A Primer 15

3:Corporate Governance and Risk Management 27

4 : What isERM? 37

5 : RiskManagement,Governance,Culture,and Risk Taking in Banks 47

6:Financial Disasters 59

7:Deciphering the Liquidity and Credit Crunch2007-2008 76

8:Getting Up to Speed on the FinancialCrisis:A One-Weekend-Reader's Guide 89

9:Risk Management Failures:What Are They andWhen Do They Happen? 101

DelineatingEfficient Portfolios 109

10: The Standard Capital Asset Pricing Model 124

11: Applying the CAPM to PerformanceMeasurement:Single-Index Performance

MeasurementIndicators 139

12: Arbitrage Pricing Theory and Multifactor Models ofRisk and Return 149

13: Principles for Effective Data Aggregation and RiskReporting 163

14:GARP Code of Conduct 175

SELF-TEST:FOUNDATIONS OF RISKMANAGEMENT 182

FORMULAS 187

INDEX 189

FRM PART I BooK 2: :(第二本目录)

QUANTITATIVE ANALYSIS

READING ASSIGNMENTS ANDLEARNING OBJECTIVES V

QUANTITATIVE ANALYSIS

The Time Value of Money 1

15:Probabilities 13

16:Basic Statistics 29

17:Distributions 53

18:Bayesian Analysis 75

19:Hypothesis Testing and Confidence Intervals 88

20:Linear Regression with One Regressor 128

21:Regression with a Single Regressor:

Hypothesis Testsand Confidence Intervals 142

22:Linear Regression with Multiple Regressors 156

23:Hypothesis Tests and Confidence Intervals inMultiple Regression 170

24:Modeling and Forecasting Trend 189

25:Modeling and Forecasting Seasonaliry 206

26:Characterizing Cycles 214

27:Modeling Cycles:MA,AR,and ARMA Models 223、

28:Volatility 233

29:Correlations and Copulas 245

30:Simulation Methods 263

SELF-TEST:QUANTITATIVEANALYSIS 276

FORMULAS 283

APPENDIX 291

INDEX 298

FRM PART I BooK3: (第三本目录)

FINANCIAL MARKETS ANDPRODUCTS

READING ASSIGNMENTS ANDLEARNING OBJECTIVES V

FINANCIAL MARKETS AND PRODUCTS

31:Banks 1

32:Insurance Companies and Pension Plans 10

33:Mutual Funds and Hedge Funds 24

34:Introduction(Options,Futures,and Other Derivatives) 40

35:Mechanics of Futures Markets 56

36:Hedging Strategies Using Futures 68

37:Interest Rates 80

38:Determination of Forward and Futures Prices 96

39:Interest Rate Futures 109

40:Swaps 123

41:Mechanics of Options Markets 140

42:Properties of Stock Options 155

43:Trading Strategies Involving Options 167

44:Exotic Options 183

45:Commodity Forwards and Futures

46:Exchanges,OTC Derivatives,DPCs and SPVs 215

47:Basic Principles of Central Clearing 225

48:Risks Caused by CCPs 236

49:Foreign Exchange Risk 243

50:Corporate Bonds 257

51:Mortgages and Mortgage-Backed Securities 270

SELF-TEST:FINANCIAL MARKETSAND PRODUCTS 296

FORMULAS 305

INDEX 309

FRM PART I BooK4: (第四本目录)

VALUATION AND RISK MODELS

READING ASSIGNMENTS ANDLEARNING OBJECTIVES V

VALUATION AND RISK MODELS

VaR Methods 1

52:Quantifying Volatility in VaR Models 12

53:Putting VaR to Work 34

54:Measures of Financial Risk 48

55:Binomial Trees 60

56:The Black-Scholes-Merton Model 77

57:Greek Letters 95

58:Prices,Discount Factors,and Arbitrage 115

59:Spot,Forward,and Par Rates 131

60:Returns,Spreads,and Yields 149

61:One-Factor Risk Metrics and Hedges 165

62:Multi-Factor Risk Metrics and Hedges 182

63:Country Risk:Dererminants,Measures and Implications 195

64:External and Internal Ratings 214

65:Capital Structure in Banks 224

66:Operational Risk 236

67:Governance Over Stress Testing 249

68:Stress Testing and Other Risk Management Tools 260

69:Principles for Sound Stress Testing Practices andSupervision 266

SELF-TEST:VALUATION AND RISKMODELS 279

FORMULAS 286

APPENDIX 291

INDEX 294

FRM 2017 PART I PRACTICEEXAMS(模拟题目录)

HOW TO USE THE FRM PRACTICE EXAMS III

PRACTICE EXAM 1 1

PRACTICE EXAM 1 ANSWERS 30

PRACTICE EXAM 2 47

PRACTICE EXAM 2 ANSWERS 77

DISTRIBUTION TABLES 94

内容不能少于5个字符!

分享

分享 收藏

收藏